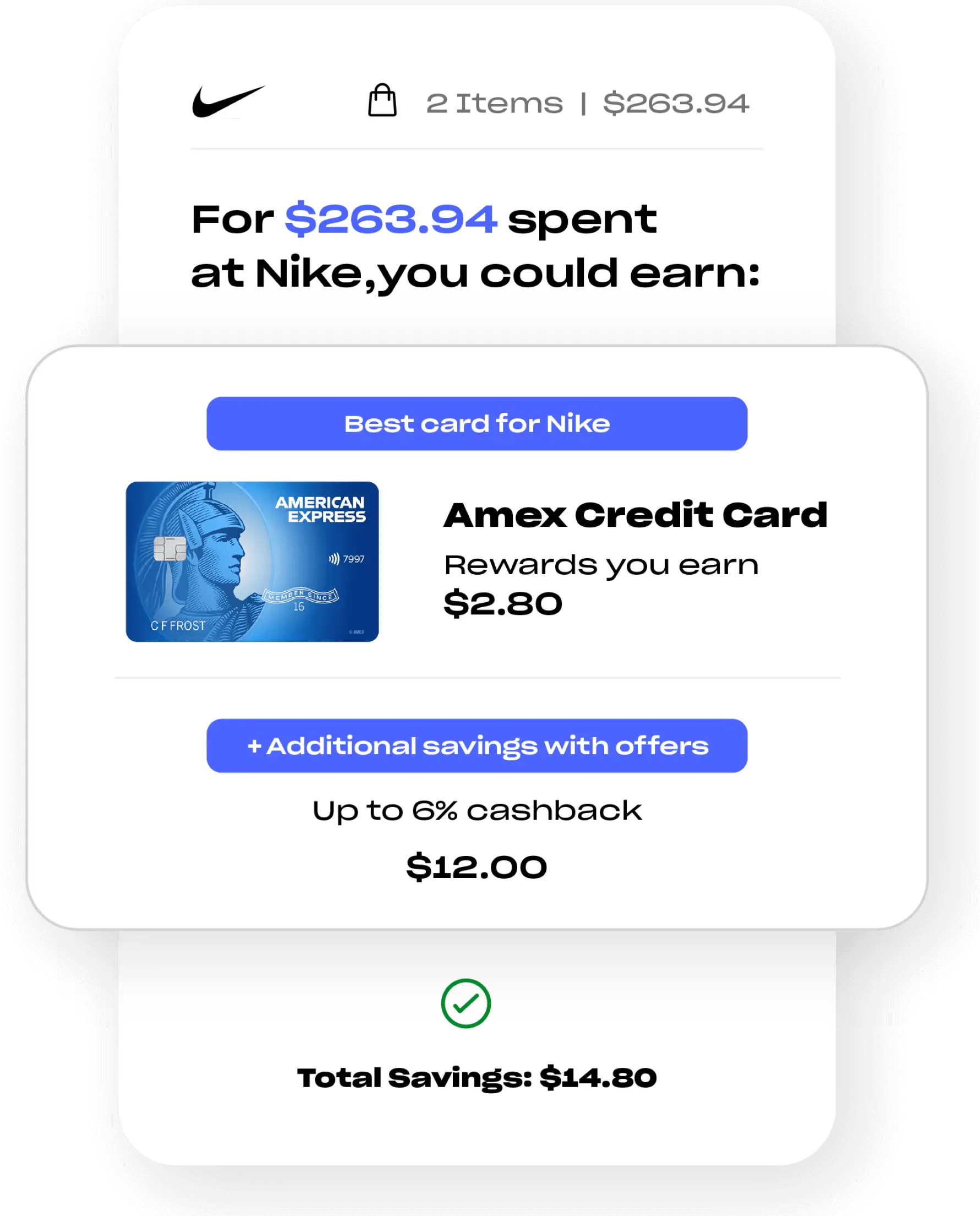

“Helps choose your best card for every purchase.”

“Recommends cards that offer better savings.”

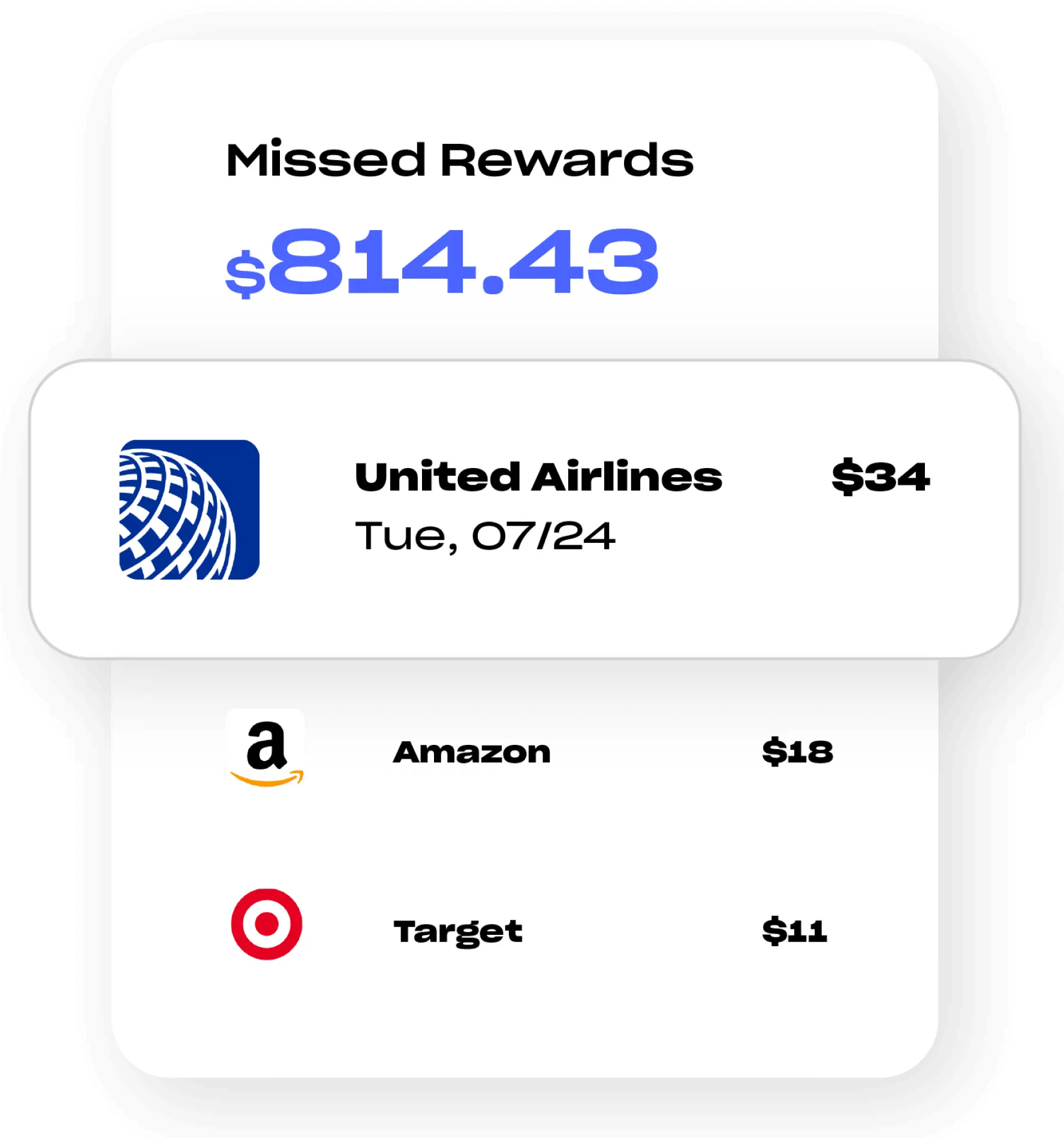

“Analyze your spending to find missed rewards.”

“Get alerts when you don’t use the best card for a purchase.”

Find Missed Rewards

on Purchases

Stay on top of rewards or

cashback you missed by not

using your best card.

Get ready for

the next trip

sooner.

Turn coffee and Uber rides into

free flights or hotel stays — with

the best card, every time.

Alerts for

Best Card

Automatic best card advice

during online shopping, or in 2

taps on the app during in-store

purchase.

AI-based Deep

Personalized

Advice.

Always pay the smartest way —

Uthrive uses AI to recommend

your best card, and savings

offers based on your unique

spend habits.

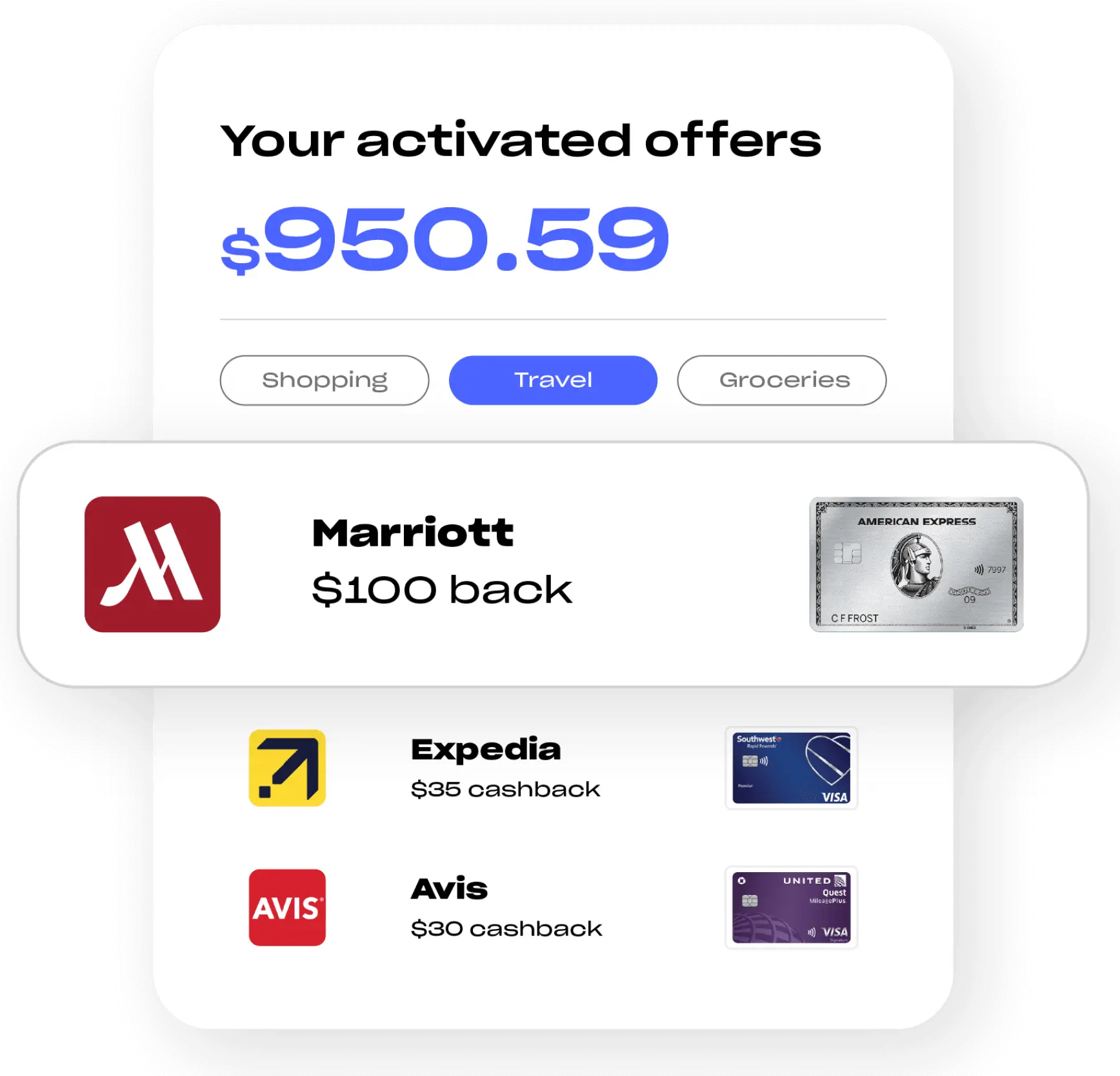

Auto-activate

Savings Offers

Get Savings offers from your bank

automatically activated* on your

credit or debit card, so you rack

up savings without even realizing.

*Available with Uthrive Premium

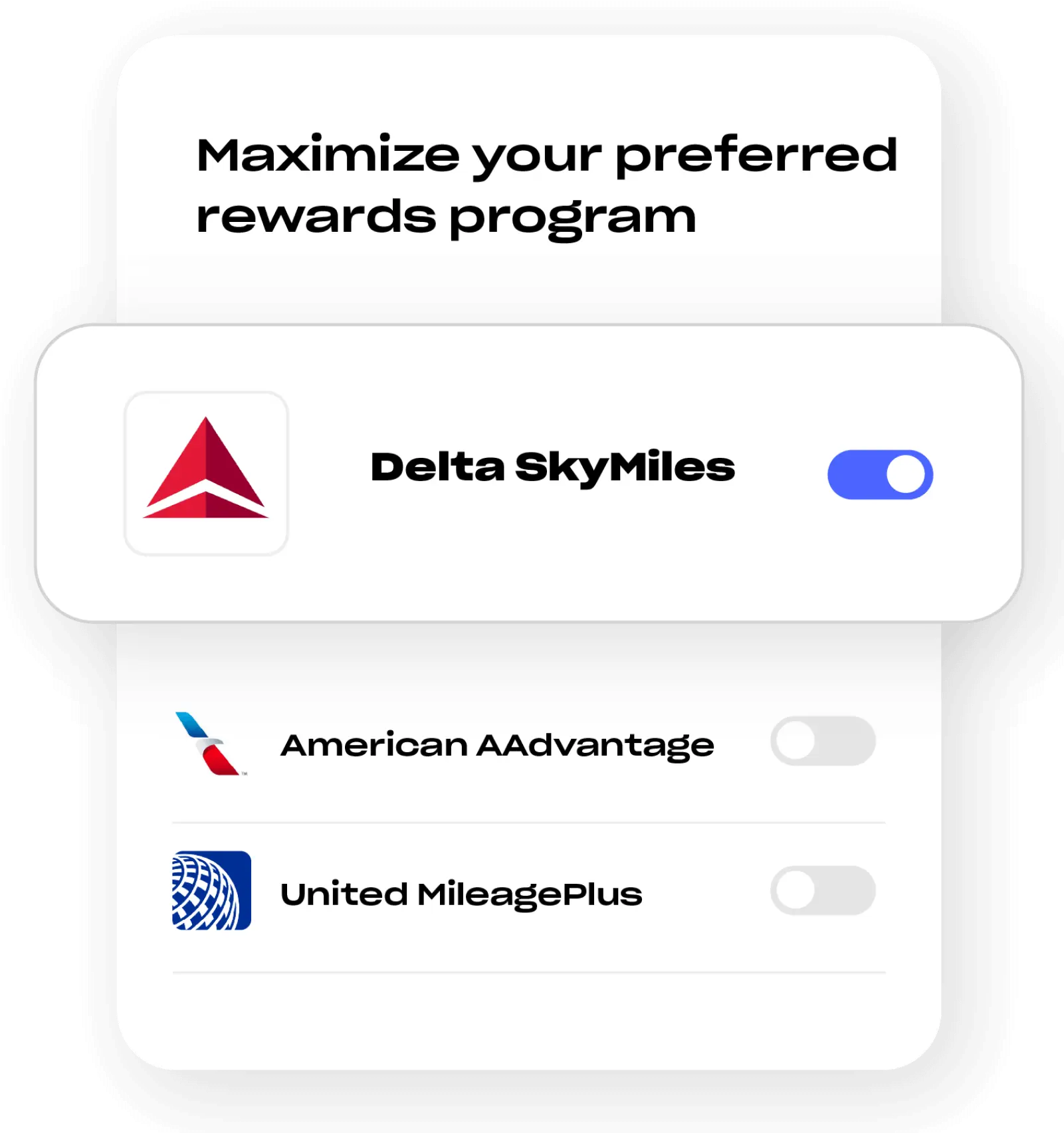

Maximize rewards of

your choice

Love flying Delta or staying at

Marriott or just plain cashback?

Just set your favorite rewards and

get advice on how to maximize them*.

*Available with Uthrive Premium

With Uthrive, Americans have saved