Do you wish to take a break and go for a holiday? But are you worried about paying for it? What if we told you you could afford a budget-friendly vacation? We can already sense your joy – planning for a family vacation or a much-awaited trip with your friends can lift your spirits.

Whether you wish to go for a weekend getaway, Road Trip, Affordable Vacation with the Whole FamJam, Camping, or an All-Boys or All-Girls Trip, your credit cards can help you pay for it. You can also learn about how you can vacation on a budget by smartly using your credit cards.

Pro Tip: Even if you have money set aside for your trip, use your credit card for the transactions. So you can immediately pay off your credit balance with cash and earn rich reward points or cashback.

Earn Rewards Fast

Now that you have your card, it is time to start collecting points. People mostly rack up their points by charging everything to their cards. Many credit cards offer a 1:1 ratio- you earn a point or a cent for every dollar you spend.

But you might even be more thrilled to know that there are faster ways to accumulate your gains. Some cards offer higher points or cashback for particular spending categories, such as:

-

Restaurants

-

Grocery & Supermarket Purchases

-

Hotel & Airlines

-

Commuting & Transit

For Example- The card_name offers 3X points on Flights, Hotels, Dining, Commuting and Transit as well as 1X points on all other purchases.

These points can be transferred to various Airlines for booking flights or upgrading to Business class or Premium Economy for much lower difference in points vs. what you would pay in cash.

card_name gives 25% more value when you redeem points for booking travel, whereas Chase Sapphire Reserve® gives 50% more value.

Redeem Points to Book and Upgrade Flights

Credit cards that offer Airline Miles/Points can help your vacation planning. Do not simply use your credit card points on any flight. 1) Check your points balance before booking the flight, 2) Compare the flight options and how many points need to be redeemed on the airline website, 3) Use your points wisely.

Generally, high-frequency routes such as New York – Chicago, Miami – LA, Austin – Denver, or flights originating/ending at their airline hubs require fewer points to be redeemed.

Many credit card sign-up bonuses cover up your flights and give you enough points for a round-trip flight for a couple. If you have fewer points than needed to be redeemed for booking the flight, you can Fly Now, pay Later with Delta Airlines using Cards such as – card_name

Free Checked Bags

Airfares can be expensive and extra fees increase the ticket traveling price even more. Bag charges are one of those expenses that can quickly add up. So if you want to spend less and pack more, this tip might save you a lot in the future. You can bring a backpack or a small carry-on bag onboard for free but would have to pay extra for checked bags.

There are many airlines with no baggage fees. Southwest Airlines is the only domestic airline with Free Checked Baggage regardless of the loyalty status. You can even invest in airline credit cards that offer built-in baggage perks. Many such cards save your money by avoiding the checked bag fees like- card_name, etc.

Zip through Airport Security – TSA PreCheck & Global Entry

With the right credit card, you can whiz past the long airport security line without paying any extra dollars. Some credit cards cover your application cost for TSA PreCheck and Global Entry. It helps you with expedited security clearance.

So if you are running late for your flight and do not want to throw a wrench at your travel plans, you must invest in cards like card_name, etc.

Enjoy Lounge Access

Do you want to escape the madness of the crowd? Airport Lounges are exclusive places where you can benefit from a wide range of perks, including- a quiet space for taking a nap, savoring hot meals or your favorite snack beverage, and even taking a shower. A few lounges even offer spas and other five-star amenities.

Some credit cards can get you complimentary access to lounges. So, you can now enjoy airport lounge access with credit cards such as Chase Sapphire Reserve®.

Get Free Wi-Fi

For many of us, it is essential to stay connected while traveling because a functional and consistent Wi-Fi connection is a must on a long flight. With Free Wi-Fi, you can catch up on your favorite show, keep your social media accounts updated about your splendid vacation, or simply browse the internet.

Some airlines offer it for free- such as JetBlue. Luckily for others, the key to free Wi-Fi might already be in your wallet! A few travel reward credit cards allow you to stay online even at 30,000 feet in the air. The AAdvantage® Aviator® Red World Elite™ Mastercard® offers complimentary Wi-Fi on American Airlines.

Stay In Luxury

Similar to Airline Points, various Hotel Chains offer great value with credit card points. You can get an excellent sign-up bonus worth a week’s stay- depending upon your location.

Always weigh your options by comparing hotel websites before booking your stay. It is not just about redeeming points for hotels. You can also get a complimentary room upgrade, a free airport shuttle, etc.

Typically, you earn maximum points while making purchases for hotel stays. You can also earn points for your everyday purchases- Groceries, Restaurants, Entertainment, Gas, etc. with cards like- the card_name or The World of Hyatt Credit Card.

You can conveniently earn and redeem points for the Best Family Vacation on a Budget. With a Hilton Card, you could stay at Hilton properties in smaller cities such as – Baltimore or Kansas City for as low as 10,000 points. However, a stay in NYC might cost more from 30,000 points onwards.

Complimentary Breakfast

We all love free things, so why not stay in a hotel with a complimentary breakfast, a perk anyone would enjoy. Food expenses can accumulate quickly; when you are on a family vacation or trip with your friends. You can get great value by getting a Free Breakfast which also tends to be convenient at the hotel you are staying at.

Book your hotel stay using credit card points. You could use credit cards like- Hilton Honors American Express Aspire Card, Marriott Bonvoy Brilliant® American Express® Card, and card_name.

Free Airport Shuttle Service

There are several little details you need to consider while planning your trip. The major ones are plane tickets, food, and accommodation. Nowadays, many hotels have started offering a Free Shuttle Service to and from the airport. It makes your journey more convenient as a part of your hotel service.

Other Benefits

Did you think that was it? The answer would be NO, as Credit cards are full of surprises. Every card has its perks, and it is completely your choice to pick a credit card that suits your needs. Apart from Hotel Points, users can dig in various other perks like- no foreign transaction fee, travel insurance, lost baggage insurance, car rental privileges, purchase protection with cards such as card_name, etc.

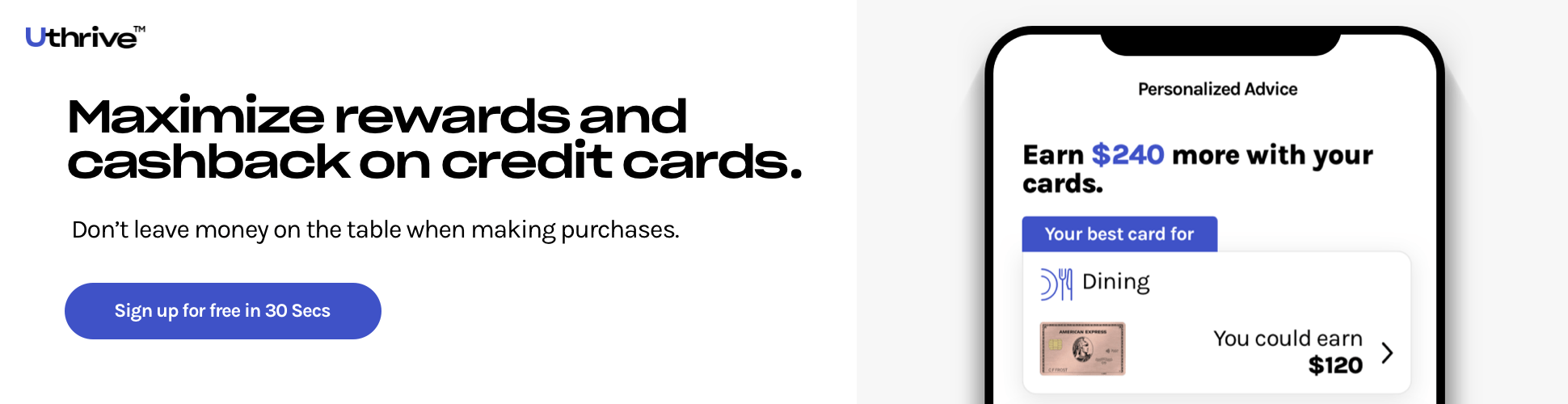

Download the Credit Card Management App

You should track your spending and use the right credit cards to save for a big one and utilize them for Planning a Family Vacation. Before you realize it, you accumulate enough cash back or points to fund at least a part of your vacation or all of it! That’s the magic of Uthrive – One of the Best Credit Card Management Apps loved by consumers.

With the innovative features of the Uthrive App, you can keep a record of all your expenditure and rewards earned & lost. It helps you get the most out of your credit card rewards and discount offers on every purchase you make.

You even learn about the potential reward points and cashbacks you can earn. Uthrive App assists you in maximizing your credit card rewards most effectively.

Bottom Line

You no longer have to finance your whole trip with cash, as your credit cards can effortlessly turn your dreams into reality. So you can create unforgettable memories and fund your travel easily. Family Vacation Packages or Bachelorette Planning, Uthrive can assist you in the best possible ways.