Most people have multiple credit cards, and sometimes managing them all can be a challenge. While a debit card makes it easy to track how much you have spent or how much money is left, one must stay on top of how much is spent on credit cards to avoid unnecessary stress afterward.

At the same time, many credit cards offer a plethora of benefits and must-not-miss perks. It is where Credit Card Management Apps come into play. They help you keep your spending in order while making the most of your credit card.

These apps do the much-needed heavy lifting on your credit card use. You no longer have to sit down and analyze piles of bills and statements, nor end up paying for benefits that come built-in on your cards. They are your allies as they monitor and offer unique insights helping you stay in control.

What Credit Card Management Apps Can Do for You?

It is worth exploring these apps as they do not just remind you of your credit card balances and payment due dates to protect you from late fees but also help you earn reward points, keep your accounts and transactions in one place, manage unplanned expenditure, and so much more.

While you rely on Tracking Apps for achieving your fitness goals, why not use apps for Credit Card Management. Here are a few to consider:

1. Credit Card Budgeting Apps

By providing a detailed view of your transactions across multiple credit cards, Credit Card Budgeting App helps you manage your overall finances. These apps ensure on-time payments by giving alerts.

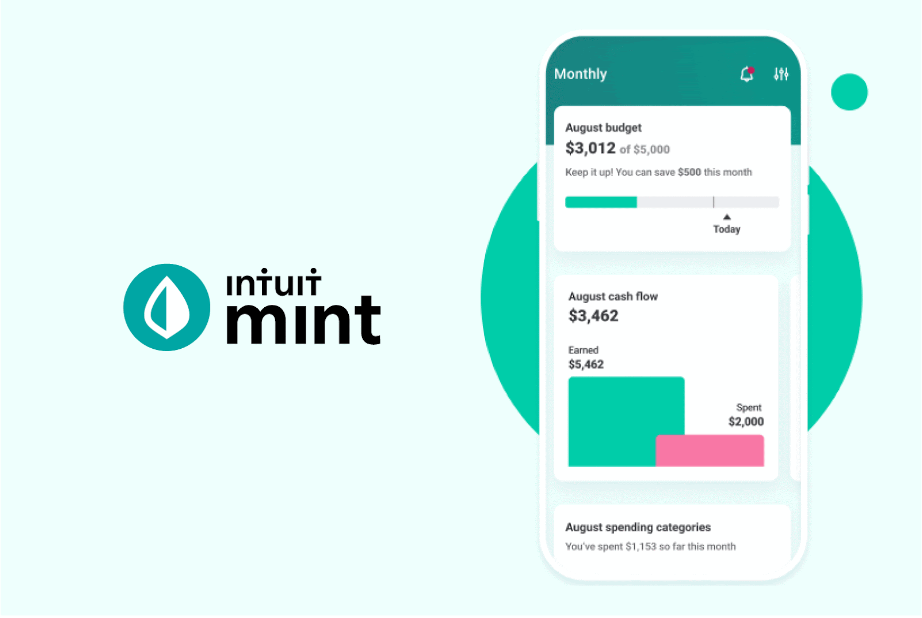

Mint is one of the most popular free budget apps for iPhone & Android that assists the user in creating budgets and tracking card expenses.

Using Mint will help you accomplish your financial goals as it is an effective personal finance management tool.

This credit card app for budgeting is highly effective in providing users with a comprehensive view of their financial landscape, particularly credit card transactions.

When integrated with no foreign transaction fee credit cards like the card_name, cardholders can seamlessly track their expenses and set realistic budgets.

This synergy enables users to maximize the reward potential of their credit cards, aligning with Mint’s goal of helping individuals achieve their financial objectives.

Additionally, the app pairs well with the no-annual fee credit card like card_name, offering users a simple and user-friendly interface to monitor spending patterns and receive timely alerts.

Image Credit- The Mint App

Why we like it: It is an effective personal finance management tool that aligns all your accounts in one place- from budgets and financial objectives to credit health and balances.

Mint helps you to monitor and budget your expenses in a better way and is undoubtedly one of the best credit card manage apps to set & track your budget goals.

You even get credit card bill alerts and a complete report of your credit score for free.

Cost: Free for both iPhone and Android Users

2. Credit Card Payment Apps

You must have a Credit Card Bill Payment app to seamlessly monitor what you owe and when it is due. It is an excellent choice to avoid late fees, increased interest rates, and potential impact on your credit score.

A Credit Card Payment App creates a personalized calendar for your upcoming and paid bills.

It even allows you to make same-day payments or even schedule them. Just sign up and add your card to give the Credit Card Manager App access to your current statement.

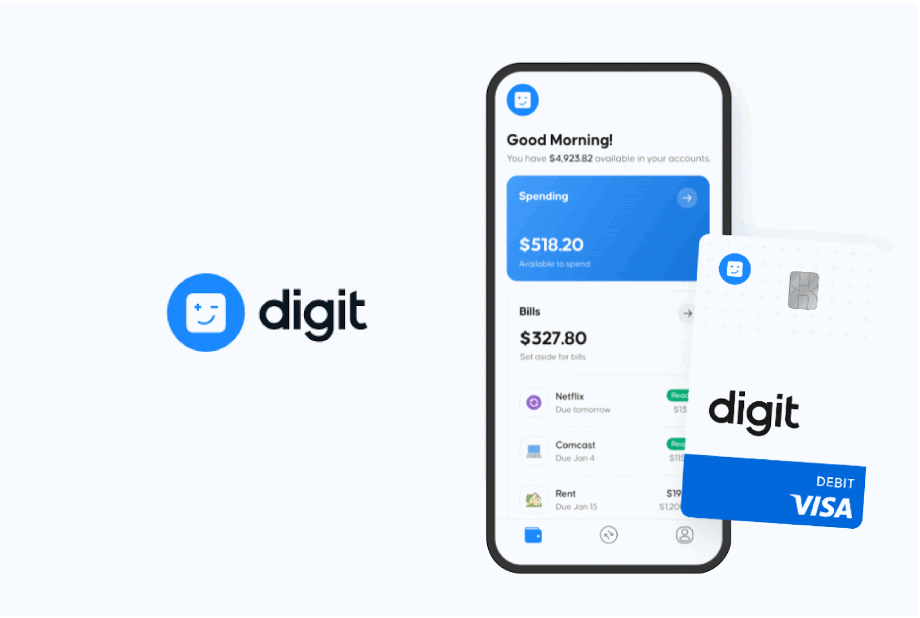

The Digit App is the best choice for saving and investing money effectively and paying your bills on time without any hassle.

It is a standout credit card app for payments that streamlines bill management and savings to stay financially disciplined.

When paired with credit cards like the card_name or card_name, Digit ensures timely bill payments, avoids late fees, and enhances the user’s credit-building journey.

Digit also complements the card_name – one of the best balance transfer credit cards, seamlessly integrating with its cashback structure, with the card’s focus on earning unlimited 2% cash back on purchases and bill payments.

By synchronizing with these credit cards, the app not only facilitates effortless bill payments but also encourages a savings habit through its automated investing feature.

Image Credit- The Digit App

Why we like it: It is an excellent app for credit card management, allowing non-savers to save money without any effort by automatically investing the perfect amount in the right direction.

After saving for three consecutive months, you also receive a 0.10% annual savings bonus.

Digit smartly plans your spending and bill and gives you the little push you need to kick start your savings habit.

Cost: Free Bill Reminder App for Android & iPhone

3. Monitor Credit Card Benefits

Most of the time, users are not fully aware of many Credit Card Offers and benefits like- Travel Insurance Perks, Extended Warranties, Purchase Protection, free checked bags, and more.

Most banks offer easy access to information about these benefits via their mobile apps such as Chase, Amex, Wells Fargo and Capital One.

It is worth downloading the app as it monitors credit card benefits for travel. It includes statement credit for TSA PreCheck membership, car rental insurance protection, dining perks (Doordash pass, Uber pass, etc.), extra reward points for Lyft rides, excellent flights with Delta SkyMiles or United MileagePlus, and unlock luxury hotel stays with Marriott Bonvoy or Hilton Honors.

These Mobile Banking Apps keep you updated with the recent credit card offers, offer more convenience, better security, and lots more.

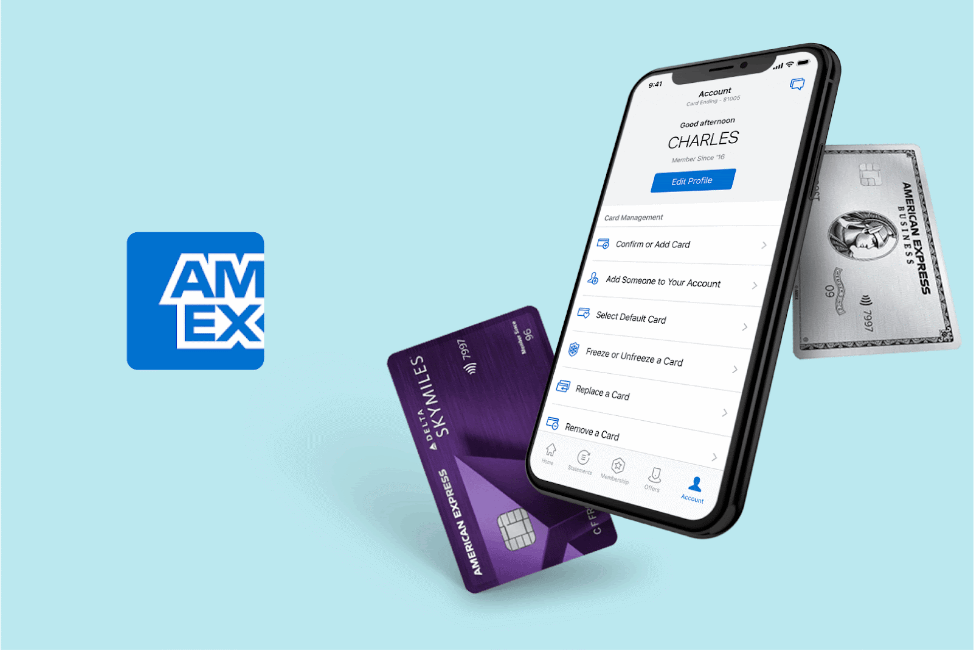

Monitoring credit card benefits becomes seamless with dedicated apps such as the Chase App, American Express App, and Capital One App.

With these apps that streamline information about benefits, users can leverage their credit cards to the fullest.

The Chase App, coupled with the card_name or the Chase Sapphire Reserve®, helps to maximize Chase Ultimate Rewards and offers users insights into a plethora of benefits like travel protection, statement credits, and car rental insurance.

Similarly, the Amex App, complemented by the card_name or card_name, provides easy access to exclusive offers, dining perks, and automated payment features, ensuring users enjoy a tailored and rewarding experience.

The Capital One App, paired with the card_name or card_name, keeps users updated on travel perks and annual credits, while also boosting their Capital One Miles.

Image Credit- The American Express App

Why we like it: It helps you monitor your transactions and notifies you about the excellent monthly saving offers of your credit card. With the best credit card manager apps, such as Amex Mobile App, you can track your spending and rewards as well. The App also allows you to automate your payments while protecting you from fraud.

Cost: Available for Free for iOS & Android

4. Apps to Maximize Credit Card Rewards

While credit cards offer reward points and cashback, it’s nearly impossible to know which card to use to maximize the rewards and cashback from your spending.

There are apps that not only consolidate your Credit Card Rewards in one place, including American Express Membership Rewards, Chase Ultimate Rewards, Citi ThankYou Points, and more.

Maximize Credit Card Rewards App offers personalized advice for effectively utilizing credit cards for your purchases and accessing the benefits.

It even accumulates enough rewards to travel by using the miles and points collected through the app.

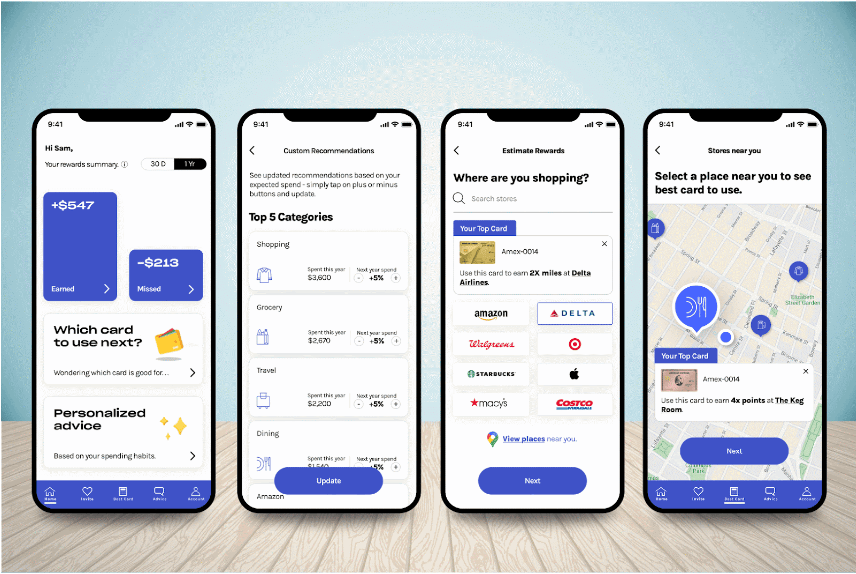

If you are looking for an app to get the Best Credit Card Rewards, download the Uthrive App to maximize your rewards points.

Uthrive, an innovative app designed to maximize your credit card rewards, is a game-changer for users aiming to make the most of their credit card benefits, be it using the best credit card for Streaming Services, Grocery Shopping, or Gas.

When coupled with credit cards like the Chase Freedom Flex®, this rewarding app strategically guides users on which card to use for transactions, ensuring optimal rewards accumulation.

Additionally, its compatibility with the card_name enhances the user experience by providing personalized recommendations based on spending categories and location and boosting their Citi ThankYou Points.

Uthrive’s utilization of AI-based algorithms offers an overall view of potential rewards, allowing cardholders to make informed decisions.

Why we like it: Link your credit and debit cards, which lets you know which card to use for the transaction.

Uthrive, with its innovative Al-based algorithms, is the best app to manage credit cards that gives you an overall picture of rewards you may be missing out on.

It even offers personalized recommendations on cards you should consider based on your location and spending category, so you do not leave hundreds of dollars on the table.

Cost: Free for Apple & Android Users

Bottom Line

Whatever your credit card preferences are, you can easily find a Credit Card Management App to help accomplish them.

Choose the right app to fulfill your goals, travel for less, maximize your experience, avoid extra charges, keep a track on your credit card rewards program, or earn more from your everyday spending.